Algorithmic trading software is a tool for automated trading. It uses algorithms to execute trades.

In the fast-paced world of financial markets, making quick and informed decisions is crucial. Algorithmic trading software helps traders by using pre-set rules and mathematical models to make trading decisions. This technology is widely used by institutional investors, but it’s also available to individual traders.

With algorithmic trading software, trades can be executed faster and more efficiently than by human traders alone. It reduces the risk of human error and allows for trading strategies that are too complex to be managed manually. By leveraging data and technology, algorithmic trading software aims to enhance trading performance and efficiency.

Introduction To Algorithmic Trading

Algorithmic trading has revolutionized the financial markets. It uses computer programs to trade at high speeds and volumes. This method is known for its precision and efficiency. But what exactly is algorithmic trading? Let’s explore.

Definition And Basics

Algorithmic trading uses computer algorithms to execute trades. These algorithms follow a set of rules. They analyze market data and make decisions. The goal is to trade better than humans. This software can process large amounts of data quickly.

Traders use it to find patterns and trends. It reduces human error. It also allows for faster transactions. This can lead to more profit opportunities. In essence, it is trading based on mathematical models.

History And Evolution

Algorithmic trading began in the 1970s. Early versions used simple algorithms. They were not very advanced. Over time, technology improved. Computers became more powerful. This allowed for more complex algorithms.

By the 1990s, algorithmic trading grew. It became more popular among traders. High-frequency trading (HFT) emerged. HFT involves making many trades in a short time. It relies heavily on algorithms.

Today, algorithmic trading is common. It plays a big role in financial markets. Many traders and firms use it. It continues to evolve with technology.

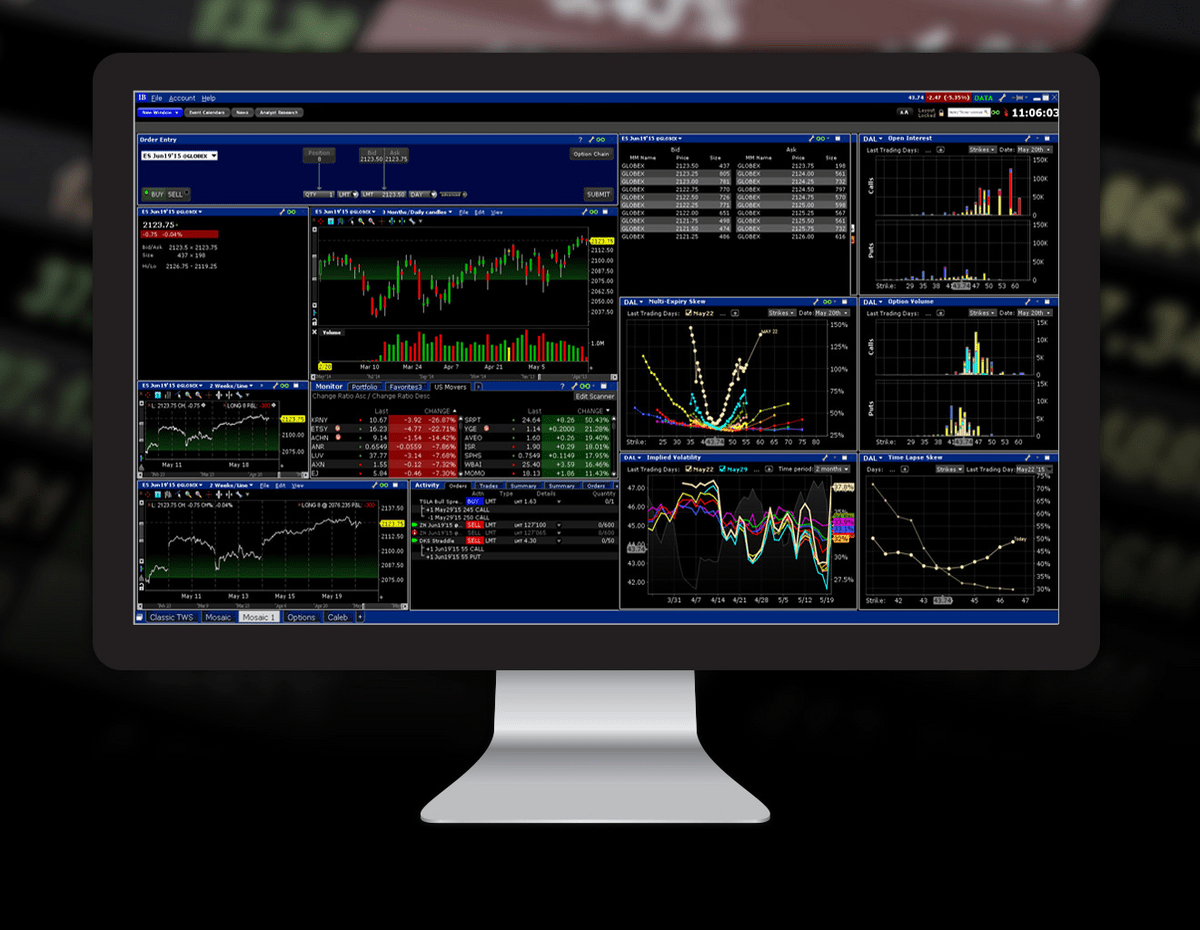

Credit: www.wallstreetzen.com

How Algorithmic Trading Works

Algorithmic trading software automates trading by using computer programs. These programs follow pre-set rules. They execute trades at high speed. This removes human error and emotions from trading. Let’s dive into how algorithmic trading works.

Key Components

There are several key components of algorithmic trading software. First, we have the trading strategy. This is the set of rules the software follows. The strategy might rely on technical indicators. Or it could use historical data. It can also combine many factors.

Next is the data feed. This provides real-time market data. The software needs this to make decisions. Without accurate data, the strategy could fail. Connectivity is also crucial. The software must connect to exchanges. This allows it to place orders quickly.

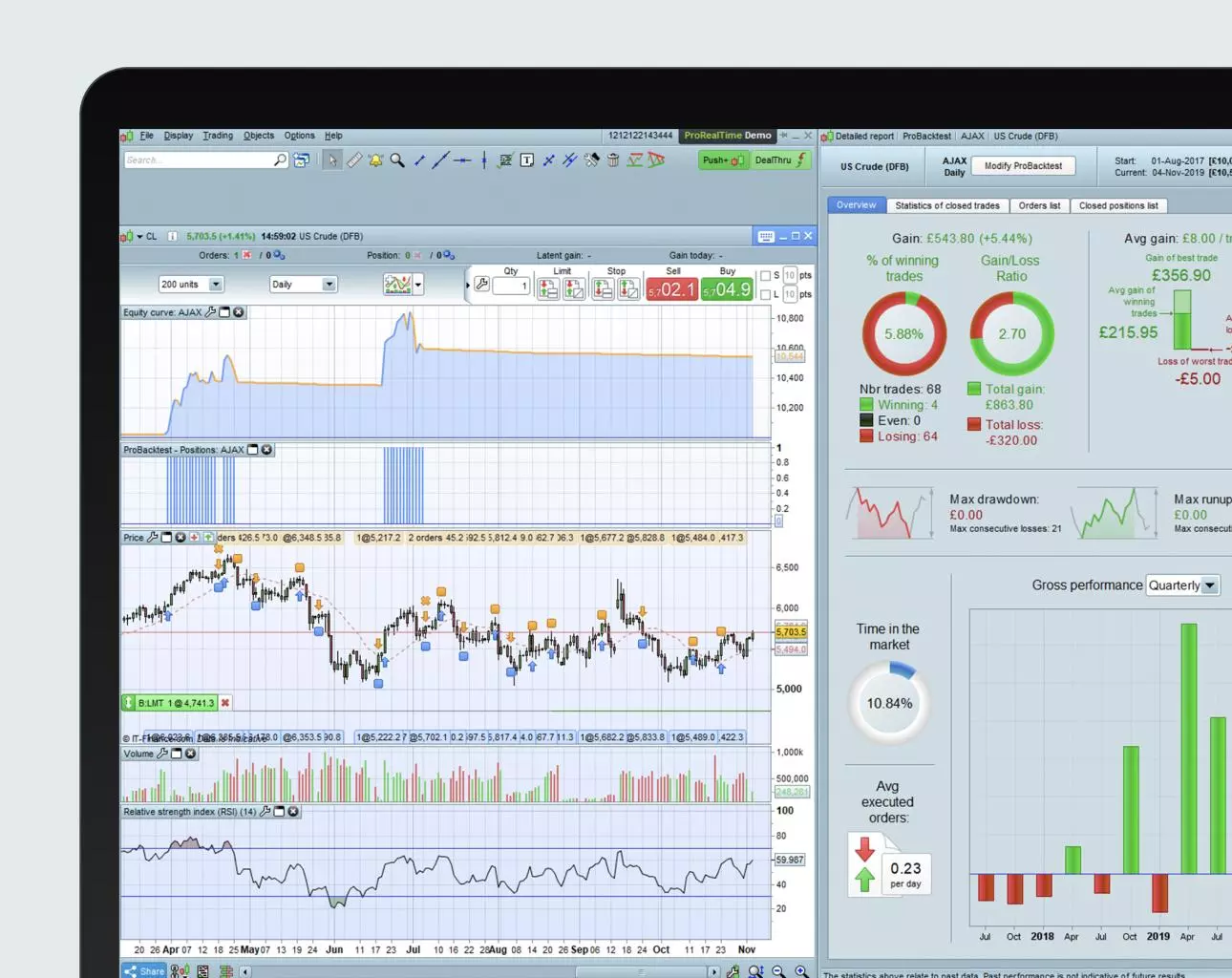

Risk management is another key component. The software must monitor risks. It should limit losses and protect gains. Finally, there is the backtesting feature. This tests the strategy against historical data. It helps refine the rules before real trading.

Types Of Algorithms

There are various types of algorithms used in trading. Trend-following algorithms are common. These track the market’s direction. They buy in uptrends and sell in downtrends. Mean reversion algorithms work differently. They assume prices will revert to the mean. If a price is too high, they sell. If it’s too low, they buy.

Arbitrage algorithms find price differences. They exploit these differences for profit. They buy low in one market and sell high in another. There are also market-making algorithms. These provide liquidity. They place buy and sell orders at the same time. Their goal is to earn the spread between prices.

Lastly, there are execution algorithms. These aim to trade large orders without moving the market. They break the order into smaller parts. This reduces the impact on the market price.

Benefits Of Algorithmic Trading

Algorithmic trading software has gained popularity in recent years. It offers traders numerous advantages. These benefits can significantly improve trading performance and experience. Let’s explore two key benefits of using algorithmic trading software.

Speed And Efficiency

One of the most significant benefits is speed and efficiency. Algorithmic trading software can execute trades in milliseconds. This is much faster than any human can achieve. Speed is crucial in the trading world. Prices can change in an instant, and a quick response can make a big difference.

The software also processes vast amounts of data quickly. It analyzes market trends and historical data. It identifies profitable trading opportunities. This efficiency saves time and effort for traders. They can focus on strategy rather than manual tasks.

Reduced Emotional Bias

Traders often make decisions based on emotions. Fear and greed can cloud judgment. Algorithmic trading software eliminates this emotional bias. It follows predefined rules and strategies. This ensures trades are made logically and consistently.

By removing emotions, the software helps maintain discipline. It sticks to the plan, even during market volatility. This can lead to more stable and profitable outcomes. Traders can trust the software to make objective decisions.

Risks And Challenges

Algorithmic trading software has transformed financial markets. It offers speed and efficiency. Yet, it also comes with its own set of risks and challenges. Understanding these risks is crucial for any trader. In this section, we will delve into two key areas: market volatility and technical glitches.

Market Volatility

Market volatility can pose significant risks. Rapid price changes can disrupt algorithms. This can lead to unexpected losses. Algorithms may react too quickly to market events. This can amplify price swings.

During high volatility, liquidity can dry up. This means fewer buyers and sellers. It can be hard to exit a position. Below is a table showing the impact of volatility:

| Market Condition | Impact on Algorithm |

|---|---|

| High Volatility | Amplified price swings, liquidity issues |

| Low Volatility | Stable prices, easier to predict movements |

Technical Glitches

Technical glitches can occur at any time. They can have serious consequences. Software bugs can cause errors in trading. These errors can result in financial losses.

Network issues can also disrupt trading. A slow connection can delay order executions. This can lead to missed opportunities or losses.

- Software bugs

- Network issues

- Hardware failures

Monitoring and maintenance are essential. Regular updates can help reduce risks. Keeping systems in good condition is key.

Popular Algorithmic Trading Strategies

Algorithmic trading software uses complex algorithms to automate trading strategies. These strategies can analyze data and execute trades faster than humans. Let’s explore some popular algorithmic trading strategies.

Trend Following

Trend following is a simple yet effective strategy. It aims to capitalize on the direction of market trends. Here are some key points:

- Uses moving averages to identify trends

- Works well in trending markets

- Relies on technical indicators like MACD and RSI

This strategy follows the principle of “buy high, sell higher” or “sell low, buy lower”. Traders look for strong trends and ride them to maximize profits. The main goal is to identify and follow the market’s direction.

Mean Reversion

Mean reversion is another popular algorithmic trading strategy. It assumes that prices will revert to their mean or average over time. Here are its main aspects:

- Identifies overbought or oversold conditions

- Uses statistical indicators like Bollinger Bands

- Effective in range-bound markets

This strategy buys when prices are low and sells when they are high. The idea is that extreme price movements are temporary and will revert to the average. Traders use this strategy to capitalize on price corrections.

| Strategy | Market Condition | Key Indicators |

|---|---|---|

| Trend Following | Trending | Moving Averages, MACD, RSI |

| Mean Reversion | Range-Bound | Bollinger Bands, Statistical Indicators |

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

Credit: www.investopedia.com

Choosing The Right Software

Choosing the right algorithmic trading software is crucial for successful trading. The right software can help you make better decisions and automate complex trades. But with many options available, how do you choose the best one? This section will guide you through the key features to look for and top software options available.

Features To Look For

When selecting trading software, consider these important features:

- Ease of Use: The software should be user-friendly. It should be easy to navigate even for beginners.

- Backtesting: Look for software that offers backtesting. This helps you test trading strategies using historical data.

- Real-Time Data: Ensure the software provides real-time market data. This is essential for making timely decisions.

- Customization: The software should allow customization. You should be able to tailor it to your trading style and needs.

- Security: Security features are vital. Your data and transactions should be protected from threats.

Top Software Options

Several software options stand out in the market. Here are a few top choices:

- MetaTrader 4 (MT4): A popular choice among traders. It offers advanced charting and analysis tools.

- TradeStation: Known for its powerful trading tools and backtesting capabilities.

- NinjaTrader: Provides robust features for both beginners and advanced traders. It includes excellent charting and analysis tools.

- AlgoTrader: Ideal for those looking for a comprehensive algorithmic trading platform. It supports multiple asset classes.

- QuantConnect: A cloud-based platform. It offers extensive backtesting and research capabilities.

Regulations And Compliance

Algorithmic trading software is a powerful tool for traders. Yet, it comes with the need for strict regulations and compliance. These regulations ensure fair practices and protect market integrity. Understanding the legal and ethical requirements is crucial for anyone using this software.

Legal Requirements

Every country has laws governing algorithmic trading. These laws vary but aim to prevent market manipulation. Traders must register with regulatory bodies. They must also comply with reporting requirements. Violating these laws can lead to severe penalties. Thus, understanding and adhering to legal requirements is vital.

Ethical Considerations

Ethical considerations go hand in hand with legal requirements. Traders must avoid strategies that harm the market. This includes tactics that create artificial price movements. Ethical trading also means being transparent with clients. Trust is the foundation of any trading relationship. Adhering to ethical practices ensures long-term success.

Future Of Algorithmic Trading

The future of algorithmic trading is bright and promising. Rapid advancements in technology and evolving industry trends are shaping this future. In this section, we will explore the key factors driving the next phase of algorithmic trading.

Technological Advancements

Technology plays a crucial role in algorithmic trading. High-speed internet and powerful processors enhance trade execution. Machine learning and artificial intelligence bring new possibilities. These technologies analyze vast amounts of data quickly and accurately. They help traders make informed decisions. Blockchain technology is also gaining traction. It offers transparency and security in trading processes. These advancements are setting the stage for smarter and faster trading systems.

Industry Trends

The industry trends in algorithmic trading are evolving rapidly. There is a growing interest in sustainable and ethical trading practices. Traders are considering environmental and social factors in their strategies. The rise of cryptocurrencies is another significant trend. More traders are incorporating digital currencies into their portfolios. Regulatory frameworks are becoming more stringent. This ensures fairness and security in the trading environment. These trends indicate a more diversified and responsible approach to algorithmic trading.

Credit: www.ig.com

Frequently Asked Questions

What Is Algorithmic Trading Software?

Algorithmic trading software automates trading using pre-defined strategies. It executes trades based on algorithms, reducing human intervention and errors.

How Does Algorithmic Trading Software Work?

Algorithmic trading software uses complex algorithms to analyze market data. It makes trading decisions and executes orders automatically, based on set parameters.

What Are The Benefits Of Algorithmic Trading Software?

Algorithmic trading software offers speed, accuracy, and efficiency. It minimizes human error, executes trades instantly, and can handle complex strategies.

Who Uses Algorithmic Trading Software?

Algorithmic trading software is used by financial institutions, hedge funds, and individual traders. It helps them execute trades more efficiently.

Conclusion

Algorithmic trading software simplifies trading by using automated strategies. It helps traders make quick, data-driven decisions. This software reduces human error and enhances efficiency. With it, even beginners can trade like pros. Stay updated on market trends for the best results.

Using this software can improve your trading experience. Consider trying it to boost your trading success.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is algorithmic trading software?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Algorithmic trading software automates trading using pre-defined strategies. It executes trades based on algorithms, reducing human intervention and errors.” } } , { “@type”: “Question”, “name”: “How does algorithmic trading software work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Algorithmic trading software uses complex algorithms to analyze market data. It makes trading decisions and executes orders automatically, based on set parameters.” } } , { “@type”: “Question”, “name”: “What are the benefits of algorithmic trading software?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Algorithmic trading software offers speed, accuracy, and efficiency. It minimizes human error, executes trades instantly, and can handle complex strategies.” } } , { “@type”: “Question”, “name”: “Who uses algorithmic trading software?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Algorithmic trading software is used by financial institutions, hedge funds, and individual traders. It helps them execute trades more efficiently.” } } ] }