Algorithmic trading can seem complex, especially for beginners. Yet, with the right software, anyone can start.

As the popularity of algorithmic trading grows, more beginners look for user-friendly tools. These tools help traders automate their strategies, saving time and reducing errors. For those new to this field, finding the best software is crucial. It must be easy to use, reliable, and educational.

The right software can make the difference between success and frustration. In this blog post, we will explore the best algorithmic trading software for beginners. Each option offers unique features to help you start trading with confidence. By the end, you will have a clear idea of which software suits your needs best.

Introduction To Algorithmic Trading

Algorithmic trading uses computer programs to trade in financial markets. It can automate trading decisions and executions. This is based on predefined rules and strategies. For beginners, it offers a structured and less emotional approach to trading.

What Is Algorithmic Trading?

Algorithmic trading is the use of algorithms in trading. These algorithms are sets of rules used to make trading decisions. They can analyze market data and execute trades faster than humans. This type of trading is also known as automated trading or black-box trading. It is popular among both small traders and large financial firms.

Benefits For Beginners

Algorithmic trading offers many benefits for beginners. One major benefit is automation. This means trades can happen without constant human supervision. It reduces the emotional impact of trading decisions. Another benefit is speed. Algorithms can analyze data and execute trades in milliseconds. This speed can be crucial in fast-moving markets.

Consistency is another important benefit. Automated trading follows set rules. This ensures consistency in trading strategies. Beginners can also backtest their strategies. They can use historical data to see how their strategies would have performed. This helps in refining and improving trading plans.

Finally, algorithmic trading can handle multiple markets and instruments. It can manage many trades at once, something that is difficult for a human to do. This allows for better diversification and risk management.

Credit: www.shiksha.com

Criteria For Choosing Trading Software

Selecting the right algorithmic trading software can be daunting for beginners. The right software can streamline your trading experience. It can help in making better decisions. But how do you choose the best software? Here are some key criteria to consider:

Ease Of Use

For beginners, the ease of use is crucial. The software should have a simple interface. It should be intuitive. You should not need extensive training to get started. Look for software with drag-and-drop features. It should also have clear instructions.

Check for demo accounts. They allow you to practice without risking real money. Tutorials and guides are also helpful. They can make your learning curve shorter.

Cost And Fees

Cost is another important factor. Some software options are free. Others may have a subscription fee. Compare the cost and fees of different software. Make sure to understand what is included in the price. Look for hidden fees. These could be for data feeds or additional features.

| Software | Cost | Features |

|---|---|---|

| Software A | Free | Basic features, limited data |

| Software B | $20/month | Advanced features, full data |

| Software C | $50/month | All features, premium support |

Support And Community

Support and community are essential for beginners. Good customer support can help resolve issues quickly. Look for software with 24/7 support. Check if they offer support through multiple channels. These can include email, chat, and phone.

A strong community can also be valuable. Forums and social media groups can offer advice. They can share tips and strategies. This can be very helpful when you are starting out.

Choose software with an active user base. This ensures you can get help and learn from others.

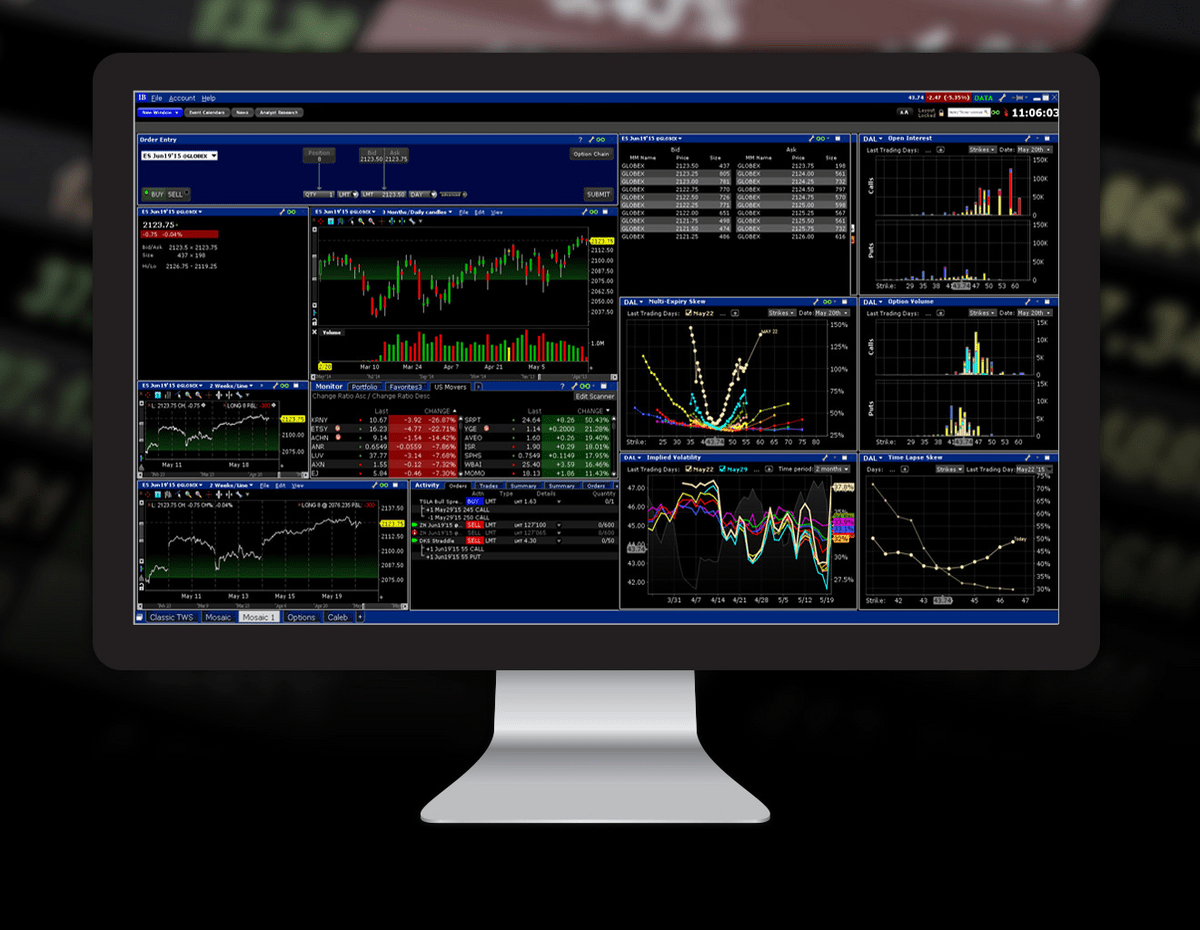

Top Pick: Metatrader 4

MetaTrader 4 (MT4) stands out as one of the best algorithmic trading software for beginners. This platform is user-friendly and offers a variety of tools to help new traders succeed. With its intuitive interface and powerful features, MT4 is a favorite among novice traders.

Key Features

- Expert Advisors (EAs): Automate your trading strategies with ease.

- Technical Analysis: Access a wide range of indicators and charting tools.

- Backtesting: Test your strategies using historical data.

- Real-time Quotes: Stay updated with live market data.

- Mobile Trading: Trade on the go with the MT4 mobile app.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Top Pick: Ninjatrader

Choosing the right algorithmic trading software can be daunting for beginners. NinjaTrader stands out as a top pick for its user-friendly interface and robust features. This software is designed to help new traders navigate the complex world of algorithmic trading with ease.

Key Features

NinjaTrader offers several features that make it ideal for beginners:

- Automated Trading: Users can create and deploy automated trading strategies.

- Advanced Charting: Provides detailed and customizable charts to analyze market trends.

- Backtesting: Test your trading strategies using historical data before going live.

- Market Replay: Replay market data to practice trading strategies in a simulated environment.

- Customizable Interface: Personalize the layout to suit your trading style and preferences.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

NinjaTrader’s blend of powerful tools and accessible interface makes it a standout choice. Beginners will find its educational resources and customizable options particularly helpful. Though it has some drawbacks, the benefits make it an attractive option for novice traders.

Top Pick: Tradestation

TradeStation offers user-friendly algorithmic trading software ideal for beginners. Its intuitive interface and robust features simplify trading strategies.

TradeStation stands out as an excellent choice for beginners in algorithmic trading. It offers a powerful yet user-friendly platform. With TradeStation, you can easily start your trading journey.

Key Features

TradeStation provides a range of key features that make it ideal for beginners:

- Easy-to-use Interface: The platform is intuitive and simple to navigate.

- Educational Resources: Offers tutorials and webinars for beginners.

- Automated Trading: Allows for the execution of trading strategies without manual intervention.

- Real-time Data: Provides access to real-time market data.

- Backtesting: Helps test strategies against historical data.

Pros And Cons

Let’s look at the pros and cons of using TradeStation:

| Pros | Cons |

|---|---|

|

|

TradeStation is a strong contender for beginners in algorithmic trading. Its blend of educational resources and powerful features makes it a top pick. “`

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

Credit: www.investopedia.com

Top Pick: Algotrader

Choosing the right algorithmic trading software can be challenging for beginners. AlgoTrader stands out as a top pick due to its user-friendly interface and robust features. This software provides an excellent platform for novices to start their trading journey.

Key Features

- Automated Trading: Execute trades automatically based on predefined strategies.

- Backtesting: Test your strategies using historical data to ensure they are effective.

- Risk Management: Tools to help manage and mitigate trading risks.

- Multi-Asset Support: Trade various asset classes including stocks, Forex, and commodities.

- Customizable Strategies: Tailor trading strategies to fit your specific needs.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Top Pick: Quantconnect

For beginners venturing into the world of algorithmic trading, selecting the right software is crucial. QuantConnect stands out as a top pick, offering a comprehensive platform for coding, backtesting, and deploying trading algorithms. Its user-friendly interface and extensive resources make it an ideal choice for those new to algorithmic trading.

Key Features

- Cloud-Based Platform: Access your work from anywhere with an internet connection.

- Multiple Language Support: Code in C#, Python, and F#.

- Extensive Data Library: Over 100TB of financial data for accurate backtesting.

- Collaborative Environment: Share and collaborate with other developers.

- Integrated Brokerage: Directly connect to popular brokerages for live trading.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Credit: www.wallstreetzen.com

Tips For Getting Started

Getting started with algorithmic trading can feel overwhelming for beginners. But, with the right approach and tools, you can make it easier. Here are some essential tips to help you get started with the best algorithmic trading software.

Educational Resources

Before you start trading, understanding the basics is crucial. Use educational resources to build your knowledge.

- Online Courses: Many platforms offer courses on algorithmic trading. These courses cover key concepts and strategies.

- Books: There are several books available on algorithmic trading. They provide in-depth knowledge and practical tips.

- Webinars: Webinars can be a great way to learn from experts. Many trading software platforms offer free webinars.

- Forums: Join online forums and communities. They can be helpful for sharing tips and asking questions.

Demo Trading

Demo trading is a valuable way to practice without risking real money. Most algorithmic trading software offers demo accounts. Here are some benefits of using demo trading:

| Benefit | Description |

|---|---|

| Risk-Free Practice | Demo accounts use virtual money, allowing you to practice without any financial risk. |

| Learn the Platform | Get familiar with the trading software and its features. |

| Test Strategies | Try out different trading strategies to see what works best. |

| Build Confidence | Gain confidence in your trading decisions before moving to a live account. |

Getting started with algorithmic trading doesn’t have to be difficult. Use educational resources to build your knowledge and practice with demo trading to gain experience. With the right approach, you’ll be well on your way to successful trading.

Frequently Asked Questions

What Is Algorithmic Trading Software?

Algorithmic trading software uses algorithms to automate trading decisions. It helps traders execute orders efficiently. This software is ideal for beginners to learn trading.

How Does Algorithmic Trading Software Work?

Algorithmic trading software uses predefined rules and algorithms to execute trades. It analyzes market data in real-time. It then makes trading decisions based on this analysis.

Why Choose Algorithmic Trading Software?

Choosing algorithmic trading software offers several benefits. It reduces emotional trading decisions. It executes trades faster than manual trading. It also helps beginners learn trading strategies.

Is Algorithmic Trading Software Suitable For Beginners?

Yes, algorithmic trading software is suitable for beginners. It simplifies trading processes. It provides valuable insights into market trends. It helps beginners understand trading strategies.

Conclusion

Choosing the best algorithmic trading software can feel overwhelming. Start with easy-to-use platforms. Look for user-friendly interfaces and strong customer support. These features help beginners learn quickly. Remember, practice is key. The right software will grow your skills. Experiment and learn from each trade.

Soon, you’ll navigate the market with confidence. Happy trading!

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is algorithmic trading software?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Algorithmic trading software uses algorithms to automate trading decisions. It helps traders execute orders efficiently. This software is ideal for beginners to learn trading.” } } , { “@type”: “Question”, “name”: “How does algorithmic trading software work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Algorithmic trading software uses predefined rules and algorithms to execute trades. It analyzes market data in real-time. It then makes trading decisions based on this analysis.” } } , { “@type”: “Question”, “name”: “Why choose algorithmic trading software?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Choosing algorithmic trading software offers several benefits. It reduces emotional trading decisions. It executes trades faster than manual trading. It also helps beginners learn trading strategies.” } } , { “@type”: “Question”, “name”: “Is algorithmic trading software suitable for beginners?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, algorithmic trading software is suitable for beginners. It simplifies trading processes. It provides valuable insights into market trends. It helps beginners understand trading strategies.” } } ] }